I have spoken with several hundred business leaders over the past couple of years, from when COVID-19 first hit the mainstream consciousness until now.

Most of these are B2B CEOs, Founders, and Managing Directors. Many of them have seen their firms decline in the past years, and yet hold the hope that their sales will rebound after COVID. With a few exceptions, I disagree: if your sales are not trending correctly right now, the outlook post-COVID is not any better.

Based on my professional analysis of the Australian B2B market:

- Good sales talent is getting harder to find

- Established businesses are getting disrupted at unusually high rates

- Yet buyers are still signing major deals

The war for (sales) talent

Australia’s talent pool has been put under real pressure through 2020 and 2021, with immigration and global mobility down in general. Anecdotally, many companies have taken a fresh look at offshoring talent, particularly for technical and process work.

Sales talent has seen one of the sharpest edges of the pandemic. 2020 was a hard year for selling: many sales teams missed targets, and many salespeople quit or lost their jobs. 2021 was not a great deal better. This left a lot of Aussies cautious of working in roles that carry a significant New Business target. Why take a difficult Sales job in a bare market, miss out on commissions, and carry the risk of being fired for nonperformance?

And Sales is a tough skill to offshore. Companies struggling to hire and retain Sales talent locally are in a difficult position.

Good Sales talent is hard enough to find normally. Right now, in Australia, it is nearly impossible to attract good salespeople without paying an above-market salary and guaranteeing OTE, at least for the short term.

New businesses putting pressure on old

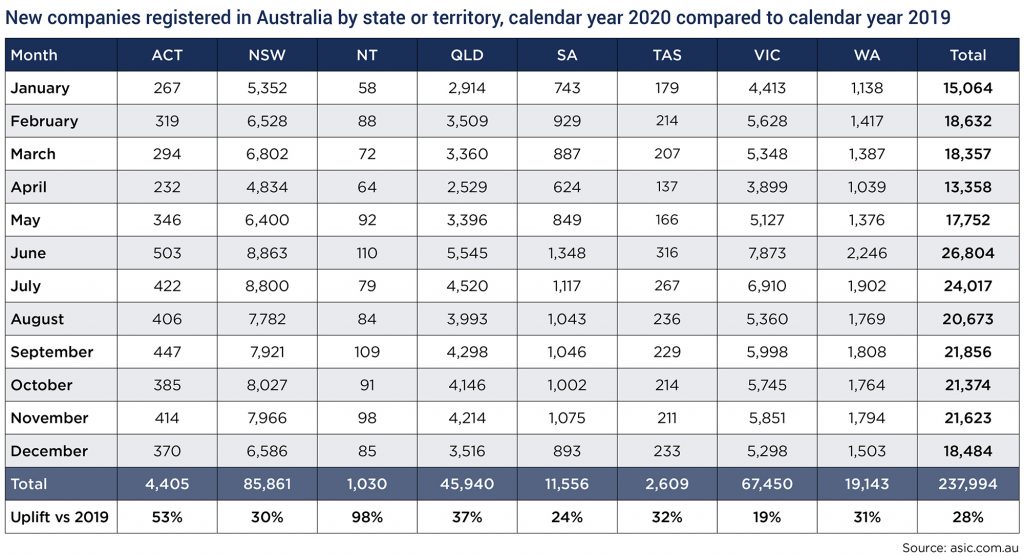

Our country saw a whopping 28% increase in new businesses registered through the 2020 calendar year, compared to 2019. The ASX200 dropped to its lowest point in over 6 years in the same period. Even at the time of publishing in February 2022, the ASX200 is only 1.3% higher than its 2019 peak.

These numbers tell a story of pressure, pain, and rebirth. While some industries and players have taken big hits, many new players have risen up underneath. And all these new companies are taking away market share from the existing players.

It is worth noting that none of the new businesses started through the 2020 period were eligible for JobKeeper benefits, which disproportionately supported established businesses suffering a downturn in sales.

Now that government support has largely passed, the playing field has levelled. If anything, the lower corporate tax rate for smaller entities favours newer businesses.

If you are an established business at this time – it is getting harder and will remain harder to sell.

Customers looking to invest

McKinsey Consulting launched a survey of B2B businesses across 11 countries in 7 sectors and 14 categories of spend in the early stages of the pandemic. Their findings were pretty clear: even when the majority of companies generally reduced spending, a significant proportion increased spend.

The recurrent theme is that smart leaders are looking to make prudent investments.

Sales skill is most needed when business-as-usual purchasing diminishes, and investment thinking takes over. Signoff moves up the chain of command, new thinking comes in, and strong sales organisations with a good value proposition win over the incumbent vendor or supplier.

I have personally observed smaller businesses in Australia win larger contracts from more significant customers than ever before, in the thick of local lockdowns and economic uncertainty. In these times, buyers still need to spend but cannot afford to spend thoughtlessly: the difference is made in the Sales cycle.

In conclusion

A battle of value is preceding the battle for market share. Firms that can demonstrate value in the sales cycle right now and then deliver on that value are the ones that will thrive post-pandemic.

This is excellent news for innovative leaders who want to carve out a niche: now is the time to invest in growth.